It’s no secret that home prices are rising across the nation. The latest numbers released by the Canadian Real Estate Association find the MLS Home Price Index rose 16% from this time last year, and the average national home price is now pegged at $519,521 – a 3.5% increase.

However, home prices have heated substantially more in some markets than others; while prices rose in 70% of all markets, reports CREA, much of reported price growth is being driven by activity in the Greater Toronto Area.

“Housing market trends continue to differ by region. Homes are selling briskly throughout the Greater Toronto Area and nearby communities,” stated CREA President Cliff Iverson. ‘Elsewhere, competition among local buyers is less intense, so listings take longer to sell.”

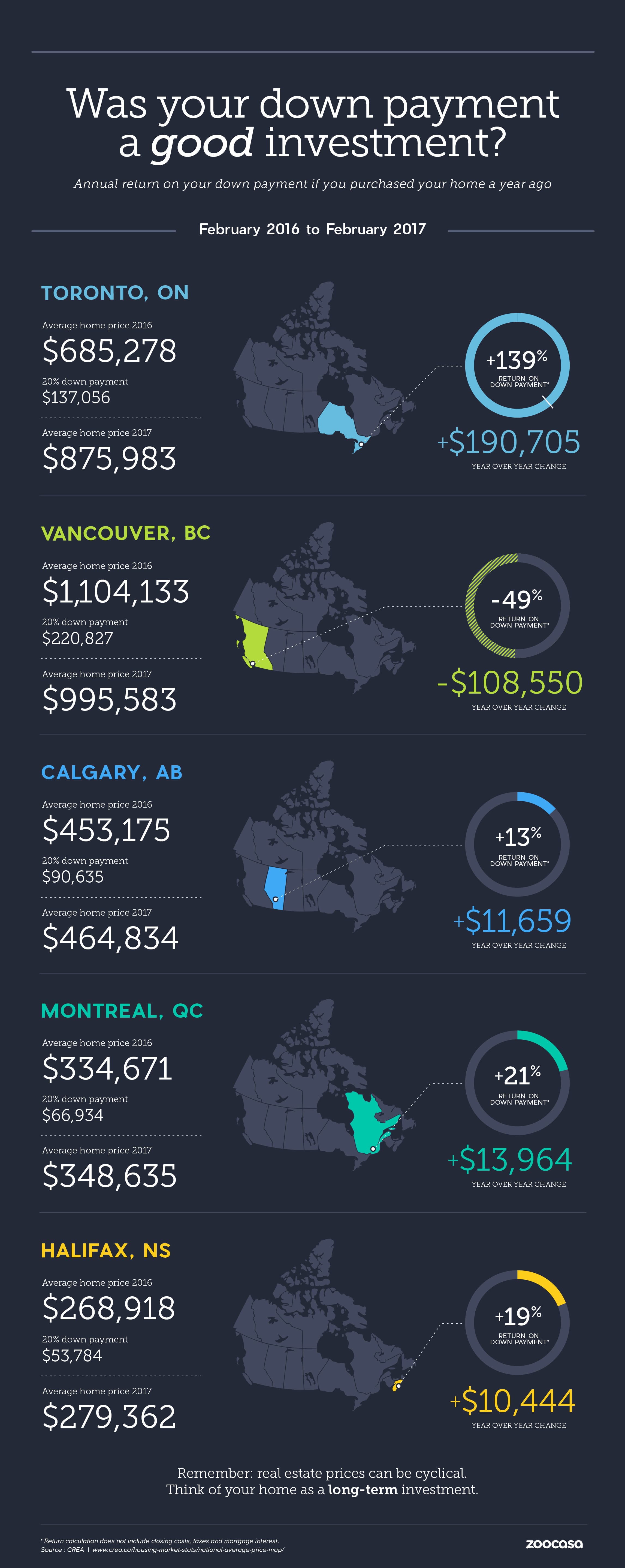

Regardless of what province and city though, it’s safe to say that real estate has been a robustly performing investment, as buyers who entered the market even just 12 months ago have seen impressive gains on their initial down payments.

Just how much have those real estate investments paid off? To find out, Zoocasa compiled the latest February CREA data to see how home prices have appreciated over the last year,

Toronto: A Runaway on Returns

Toronto real estate prices have had a banner year, and those who have already purchased in the Big Smoke have lots to cheer about. They’ve received the largest return on their down payments by far – a whopping 139%, based on a 20% down payment of $137,056 made on the average home price of $685,278 last year. These price rises have spilled into the surrounding region with “unprecedented growth” reported in the Golden Horseshoe, as housing markets in Hamilton, London and Kitchener-Waterloo heat up.

Rents in Toronto according to RentSeeker.ca’s new real-time pricing data of apartment listings across the country, showed One Bedroom Apartments in Toronto renting for $1,255, with Two Bedroom Apartment Rentals in Toronto renting for $1,496, and Three Bedroom Apartments for Rent in Toronto renting for $1,651.

Vancouver: A Slide in Prices

The numbers for the west coast city may seem alarming, as prices have seen a considerable tumble from last year’s peaks. A down payment purchase of $207,827 made on the average home price of $1,104,188 saw a -49% dip, as Vancouver prices fall below the million-mark.

However, Lauren Haw, CEO and Broker of Record at Zoocasa, emphasizes there’s no need for Vanouverite home buyers to panic. “It is important for real estate investments to be considered over the long-term. The nature of real estate as a levered investment means that year over year fluctuations serve to magnify short term returns or losses,” she says. “When the burden and potential risk of debt is properly accounted for, the ability to lever your down payment can lead to impressive equity returns.”

Calgary: A Slight Uptick

Despite several years of economic hardship resulting from slowing oil prices, Calgary’s housing market has new reason for optimism, with prices strengthening $11,659 year over year. That means a buyer who paid $90,635 on a home priced at the average $453,175, is seeing a 13% return this year.

Calgary rents according to RentSeeker.ca, showed 1 Bedroom Apartments in Calgary renting for $1,031, with 2 Bedroom Apartments in Calgary renting for $1200, and 3 Bedroom Apartments for Rent in Calgary renting for $1,471.

Halifax: Stronger Conditions on the East Coast

Meanwhile, in the Maritimes, last year’s home buyers are experiencing a 19% average return based on a $10,444 improvement in the city’s home prices, now priced at $279,362.

Follow Zoocasa and RentSeeker.ca on Twitter and Facebook and join the conversation on Canada’s Housing and Rental Markets!