Canada Mortgage and Housing Corporation (CMHC) released updated results recently from its House Price Analysis and Assessment (HPAA) framework, which is designed to detect the presence of problematic conditions in Canadian housing markets.

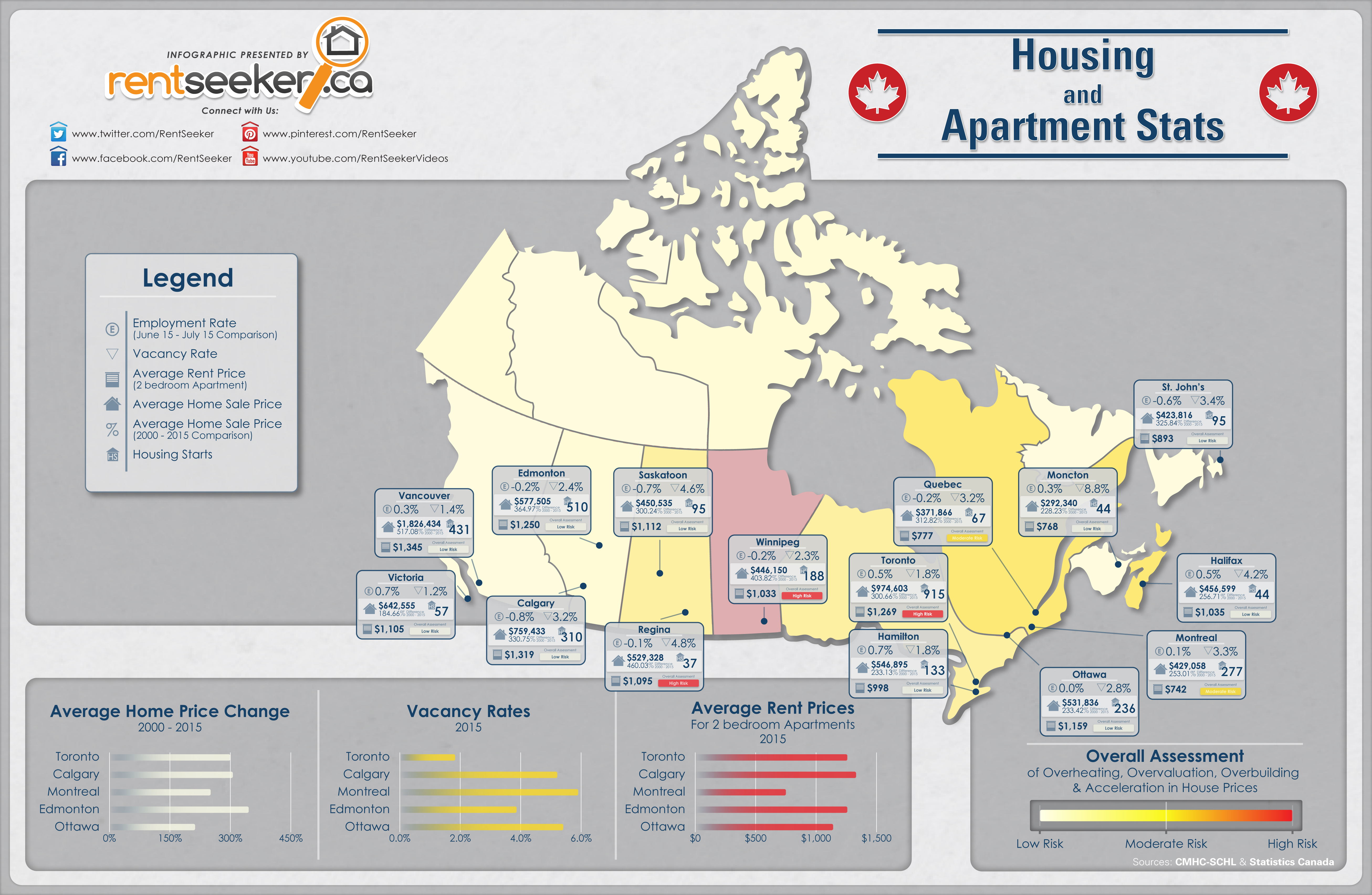

RentSeeker.ca, Canada’s leading Apartment and Housing Finder has published the House Price Analysis and Assessment information in an INFOGRAPHIC for readers to be able to view the Housing Price Analysis and Assessment in a snap-shot form for easy reference.

(Click on the INFOGRAPH to Enlarge)

The overall assessment of risk detected by the framework is high for Toronto, Winnipeg and Regina. In Toronto, the high overall risk reflects a combination of price acceleration and overvaluation. The high level of risk in Winnipeg reflects risks of overvaluation and overbuilding, while in Regina it reflects price acceleration, overvaluation and overbuilding, particularly of condominium apartments.

“Nationally, CMHC continues to detect a modest risk of overvaluation. However, our overall assessment of the risk of problematic conditions varies from centre to centre due to regional differences in housing markets. Imbalances in local housing markets could be resolved with further moderation in house prices or improving economic conditions,” said Bob Dugan, CMHC’s Chief Economist.

“In the case of Toronto, strong price acceleration in 2015 reflects a larger share of sales of pricier homes. The rise in house prices have not been matched by growth in personal disposable income, giving rise to a modest risk of overvaluation”.

The risk of problematic market conditions continues to be assessed as moderate for Montréal and Québec due to the detection of some risk of overvaluation.

In Toronto, Ottawa and Montréal, we are monitoring the risk of overbuilding. Condominium units under construction are near historical peaks. Inventory management is therefore necessary to make sure that these condominium units under construction do not remain unsold upon completion.

Low overall housing market risk is observed for Vancouver, as none of the individual risk factors are currently detected.

The results released today include those for the national market as well as 15 Census Metropolitan Areas (CMAs) – Vancouver, Victoria, Calgary, Edmonton, Regina, Saskatoon, Winnipeg, Toronto, Hamilton, Ottawa, Montréal, Québec, Moncton, St. John’s and Halifax (with Victoria, Hamilton and Moncton being added from the previous report released in April).

The centres recently added, Victoria, Hamilton and Moncton are assessed as low overall risk. None of the risk factors are detected in Victoria, while overheating is detected in Hamilton, and overbuilding in Moncton.

The HPAA is a comprehensive framework that is designed to assess housing market conditions by taking into consideration the economic, financial and demographic drivers of housing markets. The use of multiple indicators of housing conditions, which incorporate various data sources and price measures, provides a robust picture of overall housing market conditions.

CMHC’s HPAA framework is designed to detect the presence of problematic conditions in Canadian housing markets. The HPAA framework assesses housing market conditions and considers the incidence, intensity and persistence of four main risk factors:

- Overheating of demand in the housing market, wherein demand significantly outpaces supply.

- Acceleration in the growth rate of house prices, which could be partially reflective of speculative activity.

- Overvaluation in the level house prices which could be partly reflective of speculative activity.

- Overbuilding of the housing market, which suggests that supply significantly outpaces demand.

For those who feel that given the overall assessment, renting an apartment might be a better option than purchasing a home, RentSeeker.ca offers a database of thousands of apartment listings across Canada.